Nivo Teknik

Nivo Teknik İç ve Dış Ticaret

Hakkımızda

Nivo Teknik

Dolu Dolu İçerikler

Biz Kimiz?

Harita ve İnşaat sektörlerine ekonomik, kaliteli ve güvenilir hizmetler sunmak amacıyla kurulmuştur. Firmamız uzman kadrosu ile ölçüm ekipmanları, ölçüm – mühendislik hizmetleri ve inşaat faaliyetlerinde danışmanlık hizmeti vermektedir. GPS/GNSS uydu teknolojileri, Sabit İstasyon, CBS Ürünleri, Aksesuar, Nivo ve Total Station ölçü aletleri Satış ve Servis Hizmeti çalışmaları gerçekleştirmekteyiz.

Sorularınızı Yanıtlıyoruz +90 312 324 24 21

Ürünlerimiz

Ürün Gruplarımız

Kredi kartına taksit imkanı ile ürünlerimizi satın alabilirsiniz.

HİZMETLERİMİZ

Faaliyetler

ÖLÇÜM CİHAZLARI SATIŞ-KİRALAMA-TEKNİK SERVİS

TEKNİK SERVİS

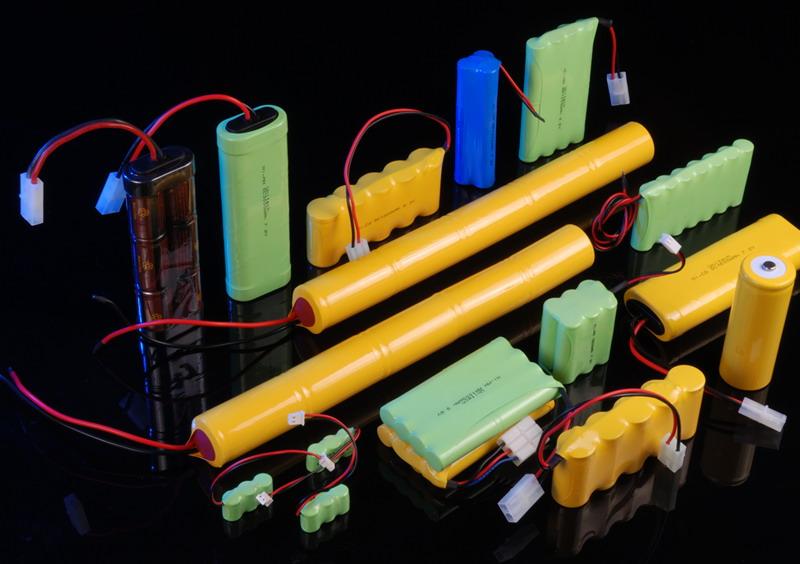

BATARYA İÇ DEĞİŞİMİ